Accounting software has become an indispensable tool for businesses, offering a digital approach to managing financial records, transactions, and compliance. Its history dates back to the early 1980s, with the rise of personal computing making tools like spreadsheets accessible to small businesses. Over time, software like QuickBooks and MYOB revolutionized accounting by automating core functions like bookkeeping, payroll, and financial reporting.

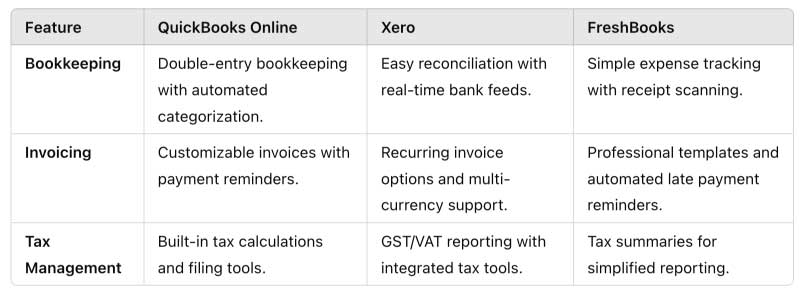

Today, accounting software spans a range of solutions, from basic tools for freelancers to comprehensive enterprise systems for global corporations. These platforms are designed to handle tasks such as tracking expenses, generating invoices, and preparing tax filings, all while ensuring accuracy and compliance with financial regulations.

The principles of accounting software include:

Scalability: Adapting to the needs of businesses, whether small or large.

Automation: Reducing manual errors by automating repetitive tasks.

Integration: Connecting with other business systems like CRM, inventory, and payroll.

The video below walks you through using some of the most popular accounting software systems and compares how they implement accounting principles for businesses.

The video introduces you to Xero, Quickbooks, and Sage, three of the most used accounting software products.

Accounting Software is a type of application that assists businesses and individuals in managing their financial activities. It helps automate and streamline a wide range of financial operations such as invoicing, expense tracking, payroll management, financial reporting, and tax preparation. Accounting software can facilitate the accurate tracking of income and expenses, simplify tax calculations, and generate comprehensive financial reports that provide valuable insights for decision-making. Its primary goal is to increase efficiency, reduce the likelihood of calculation errors, and ensure compliance with tax laws and financial regulations. These tools are used across a broad spectrum of users, from small businesses and freelancers to large corporations with more complex financial needs. As technology evolves, modern accounting software continues to integrate with other business systems and adopt advanced technologies like AI and machine learning for predictive analysis and fraud detection.

Accounting Software is an indispensable tool for businesses of all sizes, offering a comprehensive solution for managing financial operations with increased efficiency and accuracy. As financial management continues to digitalize, the capabilities of accounting software are set to grow, offering businesses even more tools to maintain their financial health and make informed decisions.