Accreditation management software is a specialized tool designed to streamline the processes involved in achieving, maintaining, and managing institutional or programmatic accreditation.

Accreditation serves as a vital benchmark of quality, demonstrating compliance with industry standards, regulatory requirements, or professional best practices. This software emerged to address the complexities of preparing documentation, tracking compliance, and managing communications with accrediting bodies. Historically, accreditation tasks were handled manually, which often involved significant time, effort, and resources.

Modern accreditation management software simplifies these tasks, offering a centralized platform to facilitate collaboration, track deadlines, and ensure adherence to standards. It is widely used across industries, particularly in education, healthcare, and manufacturing, where accreditation is a critical indicator of excellence and compliance.

Here are some of the most common examples of accreditations that require software to be managed effectively.

Accreditation Management Software involves several core features designed to help institutions automate the process of meeting and maintaining accreditation standards. The chart below takes a look at the 10 core features of accreditation management software and assesses some of the most popular products (AccredHub, WeaveAccredit, and CertiTrack) in regard to their implementation of those core features.

The video below walks through how to obtain and manage LCME accreditation for medical schools. The video is made by ARMATURE Fabric, an accreditation management platform designed to streamline compliance processes, manage standards, and enhance audit readiness across various industries.

The screenshot below is an example of an enterprise approach to accreditation management. You can see that the organization is managing several different accreditations, each with timelines and details that need software to keep them organized.

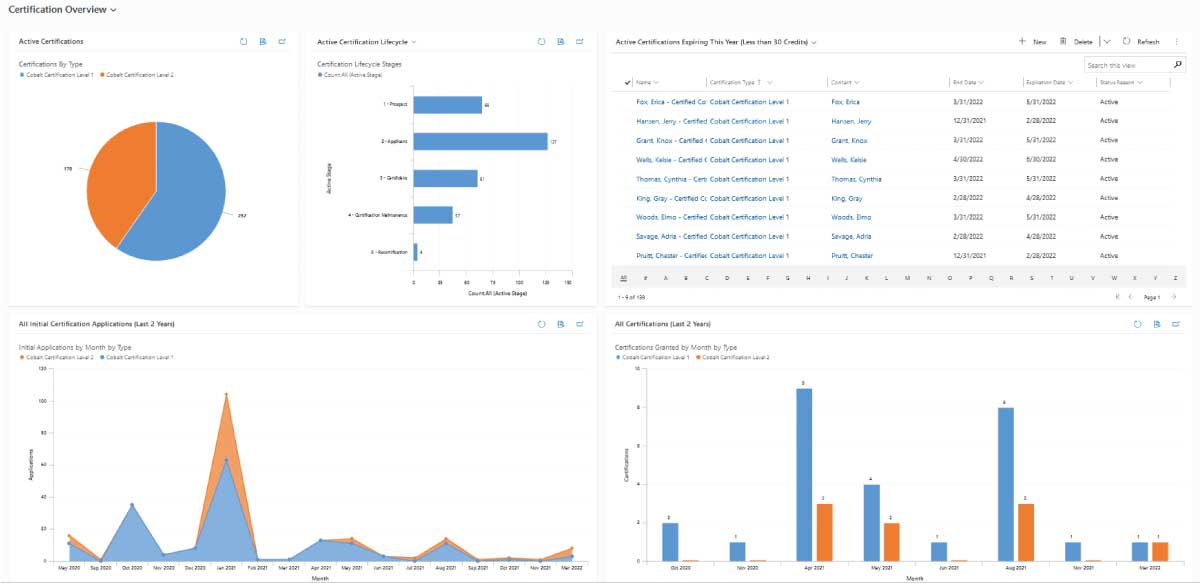

Cobalt’s accreditation and certification solution is built on Microsoft Dynamic 365 enterprise software for enterprises. The Cobalt dashboard screenshot shown above demonstrates the capabilities of an accreditation management software tool. Accreditation software for smaller organizations is also available as separate products, many of which integrate with popular Customer Relationship Management (CRM) tools and other systems.

Accreditation management software implementations are as varied as the accreditations and certifications whose requirements drive this category of software. However, there are several key features of accreditation management software that most products include.

AMS is beneficial in industries such as healthcare, higher education, manufacturing, and business. Any organization requiring compliance with standards from accrediting bodies—such as universities, hospitals, or corporations adhering to ISO standards—can significantly benefit.

AMS automates manual tasks, organizes documentation, and provides real-time insights, enabling teams to focus on critical compliance work rather than administrative tasks. Its collaboration tools and audit preparation features further streamline the process.

Yes, most AMS platforms are highly customizable, allowing organizations to adapt workflows, templates, and reports to meet their unique accreditation requirements.

Yes, specialized A/R software like Versapay or Esker’s A/R solution includes tools for managing customer credit more effectively. These platforms assess customer creditworthiness using internal data and integrate with credit bureaus to determine appropriate credit limits. They also monitor payment histories to identify risky customers, helping businesses take preemptive action, such as adjusting payment terms or initiating early follow-ups on overdue invoices, to reduce bad debt risks.

Integrating A/R software with ERP systems (e.g., SAP or Oracle NetSuite), CRM platforms (e.g., Salesforce), or payment gateways (e.g., Stripe or PayPal) significantly enhances its capabilities. These integrations streamline data sharing across systems, ensuring accuracy and reducing redundancies. For example, CRM integrations allow sales teams to access real-time customer payment statuses, improving decision-making and relationship management. Payment gateway integrations automate transaction processing and reconciliation, saving time and reducing errors.

These advanced capabilities ensure that A/R software not only streamlines accounts receivable management but also provides deeper insights and proactive tools to enhance financial health and operational efficiency.