AML (Anti-Money Laundering) software is designed to help financial institutions, fintech firms, and other regulated entities comply with legal requirements to detect and prevent money laundering and financial crime. These tools automate processes like transaction monitoring, customer due diligence (CDD), and sanctions screening to meet global and regional compliance standards, such as FATF recommendations, EU AML directives, and the US Patriot Act.

Popular AML software solutions include Actimize, AML360, NICE Actimize, LexisNexis Risk Solutions, and ComplyAdvantage. Related categories include fraud detection software, risk management platforms, and compliance management tools, as these systems often complement AML functionalities.

Listed below are several examples of software products used in the AML (Anti-Money Laundering) software category.

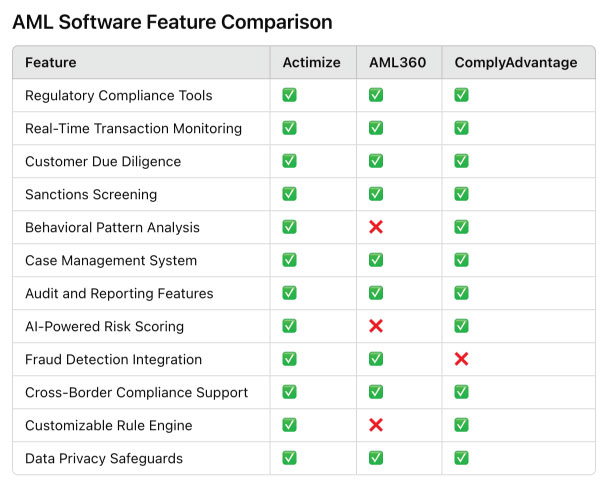

The table below compares the most essential features of AML software, highlighting their availability across three top-performing solutions in the industry. This visual overview helps businesses evaluate which platform aligns with their compliance goals and operational requirements.

The feature comparison table highlights the capabilities of three leading AML software solutions: Actimize, AML360, and ComplyAdvantage. All three platforms excel in core functionalities such as regulatory compliance, transaction monitoring, and sanctions screening. Actimize and ComplyAdvantage stand out with advanced features like AI-powered risk scoring and behavioral pattern analysis, while AML360 focuses on customer due diligence and offers robust audit and reporting tools. The table showcases variations in features like customizable rule engines and fraud detection integration, helping organizations identify the best fit for their specific compliance needs.

The video below is from Shufti Pro, and demonstrates their AML (Anti-Money Laundering) service, which quickly verifies individuals against various sanction lists to ensure legitimacy. This process aids organizations in preventing fraudulent activities by ensuring compliance with international regulations.

This AML software dashboard features a clean, flat design with key components for financial compliance teams. It includes transaction monitoring graphs to track trends and anomalies, recent alerts highlighted in red and yellow for quick identification of suspicious activities, and a sanctions screening panel to verify transactions against global watchlists. A customer risk scoring table provides profiles with associated risk levels, while actionable buttons allow users to quickly initiate investigations or generate compliance reports. The layout emphasizes usability and efficiency, making it an ideal tool for managing AML processes.

AML software streamlines complex compliance processes by integrating a range of features tailored to prevent financial crimes. From real-time transaction monitoring to automated KYC (Know Your Customer) checks, these platforms combine regulatory expertise and advanced technologies, such as AI and machine learning, to identify suspicious activities and ensure adherence to international standards. Below, we’ll dive deeper into the capabilities that define this software category.

Financial services, real estate, casinos, fintech, and insurance companies rely heavily on AML software for compliance and fraud prevention.

Many platforms support multi-jurisdictional compliance by integrating features like cross-border compliance and dynamic risk scoring.

Yes, most AML solutions integrate seamlessly with ERP, CRM, and fraud detection platforms.

PEPs are individuals with prominent public roles who may pose higher money-laundering risks due to their position.

Reputable AML solutions update databases daily or in real time to ensure accuracy in sanctions and PEP screening.

AML software leverages machine learning to detect unusual patterns and behaviors in transaction data. By continuously analyzing historical and real-time data, these systems improve their ability to identify suspicious activities, reducing false positives and enhancing accuracy.

AML (Anti-Money Laundering) focuses on preventing financial crimes by monitoring transactions and identifying suspicious activities. KYC (Know Your Customer) is a subset of AML that specifically involves verifying customer identities and assessing risk profiles during onboarding and throughout the business relationship.