Accounts Receivable (A/R) software is an essential component of modern accounting systems, designed to streamline and manage the invoicing, tracking, and collection of customer payments. While general accounting software often includes A/R functionality, specialized accounts receivable software offers advanced tools tailored to improve cash flow management, automate routine tasks, and provide in-depth reporting.

In contrast, Accounts Payable (A/P) software focuses on managing an organization’s outgoing payments, including vendor invoices and purchase orders. While A/R software emphasizes collecting revenue, A/P software is centered on expense tracking. Together, these systems form the backbone of a company’s financial operations.

Below, you’ll find a detailed guide to the features, benefits, and examples of accounts receivable software, as well as insights to help you choose the best solution for your business.

Accounts receivable (A/R) software specializes in managing invoicing, payment tracking, and collections with advanced tools like credit risk assessment and AI-driven analytics. Solutions such as Billtrust are ideal for businesses with high receivables volumes or complex payment processes, offering automation and detailed control to streamline cash flow management.

General accounting tools, like QuickBooks Online or Xero, include A/R features as part of an all-in-one financial suite. While sufficient for businesses with simple receivables needs, they lack the depth of dedicated A/R software. These tools are cost-effective and user-friendly, making them a great choice for small to medium-sized businesses managing multiple aspects of their finances.

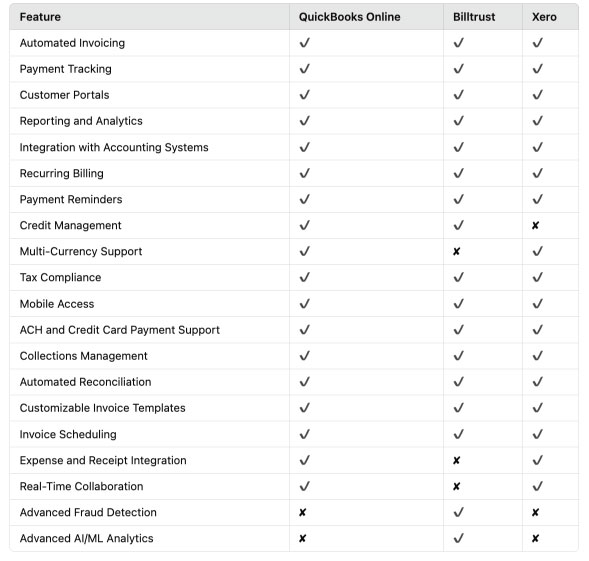

The 20 most essential features of accounts receivable (A/R) software are shown below in context of three of the most popular tools for automating accounts receivable. QuickBooks Online, Billtrust, and Xero. Billtrust is designed more specifically for accounts receivable management, whereas QuickBooks online and Xero are more general accounting software tools.

Included in his accounts receivable best practices explanation in the video below, Tim Yoder describes how to integrate A/R with a software system that works with your accounting setup.

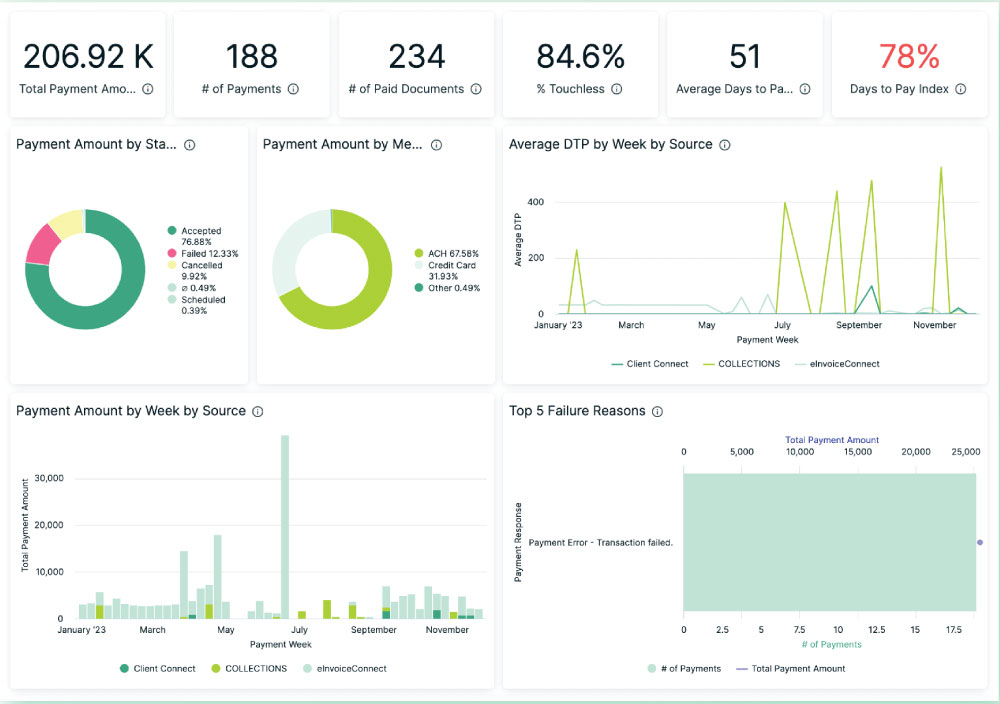

Billtrust’s Invoicing Analytics Dashboard summarizes important accounts receivable information, including days to pay data that can be used to make important decisions about customer relationships and invoicing.

Regardless of which solution you choose for to help you automate and implement accounts receivable within your organization, there are core features that are typically included with accounts receivable software. Those features include:

Accounts receivable (A/R) software helps optimize cash flow by automating the invoicing and payment collection process. Tools like Billtrust or NetSuite include features such as real-time dashboards for tracking outstanding invoices and aging receivables. They also send automated payment reminders to reduce delays and improve collection rates. Some software uses predictive analytics to forecast cash flow trends, enabling businesses to anticipate and address liquidity issues proactively.

Advanced A/R tools, such as HighRadius or YayPay, offer sophisticated automation features like credit scoring, automated dunning (collection reminders), and payment reconciliation. These systems integrate with enterprise resource planning (ERP) platforms to process payments automatically, match them with open invoices, and update accounting records in real time. Additionally, they can segment customers based on payment behavior to tailor collection strategies, improving efficiency and recovery rates.

Many A/R tools, including Xero and QuickBooks Online Advanced, support multi-currency invoicing and payment collection. They automatically convert currencies based on current exchange rates and account for variations in tax regulations across different countries. This capability simplifies financial management for businesses with global operations, ensuring compliance with international accounting standards and reducing manual errors in currency conversions.

Yes, specialized A/R software like Versapay or Esker’s A/R solution includes tools for managing customer credit more effectively. These platforms assess customer creditworthiness using internal data and integrate with credit bureaus to determine appropriate credit limits. They also monitor payment histories to identify risky customers, helping businesses take preemptive action, such as adjusting payment terms or initiating early follow-ups on overdue invoices, to reduce bad debt risks.

Integrating A/R software with ERP systems (e.g., SAP or Oracle NetSuite), CRM platforms (e.g., Salesforce), or payment gateways (e.g., Stripe or PayPal) significantly enhances its capabilities. These integrations streamline data sharing across systems, ensuring accuracy and reducing redundancies. For example, CRM integrations allow sales teams to access real-time customer payment statuses, improving decision-making and relationship management. Payment gateway integrations automate transaction processing and reconciliation, saving time and reducing errors.

These advanced capabilities ensure that A/R software not only streamlines accounts receivable management but also provides deeper insights and proactive tools to enhance financial health and operational efficiency.